In this article, we look at why the dominant investment banking business model of the last 40 years, the full-service investment bank, may not be viable in the future. We then look at what business models the banks should adopt going forward, and how they can use technology to succeed with those new business models.

Introduction

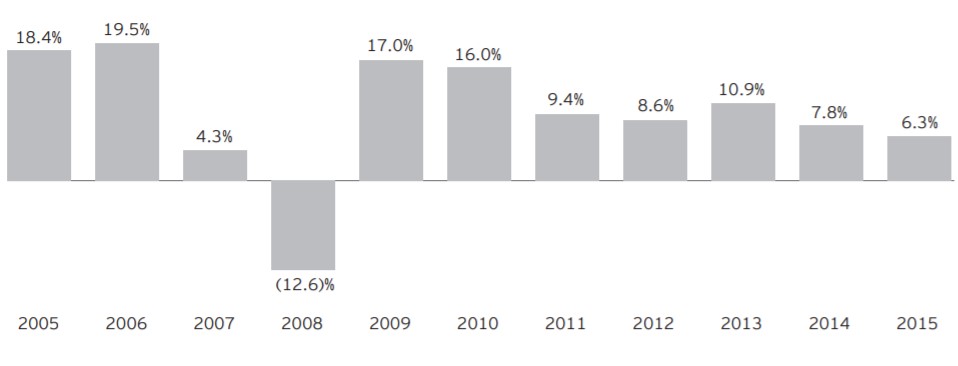

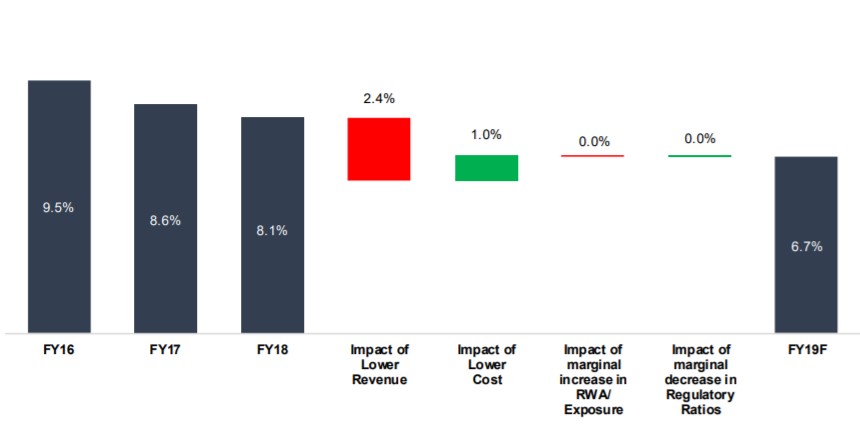

Since the financial crisis, many investment banks have found it tough going. Pre-crisis, an investment bank could expect an ROE in the high-teens, but today, single digit ROEs are the norm.

This chart from E&Y in 2016 demonstrates the decline in RoE very clearly.

This more recent chart from Coalition shows that this decline has continued.

In this article, we review the challenges that the investment banks are facing, and look at some approaches that the banks could take to deal with these hurdles.

The Traditional Investment Banking Model is Under Threat

In the past, the investment banks had a unique position within the global financial system, giving them an informational advantage. This led to the dominant business model of the last 40 years; the full-service investment bank. For corporate clients, the main benefit was the convenience of a one-stop shop, of having a single point of contact for any of their capital markets needs, from raising capital through to hedging FX risk. Another reason for the success of this model is that the client relationships that existed as a result of secondary trading could be used to place new issues for clients. And let’s not forget, that for the investment banks, this model has had the benefit of creating exclusivity; few organisations have the scale or reach to operate as a full-service investment bank, which led to the unprecedented number of mergers in financial services in the 80s and 90s.

The post-2008, post financial crisis environment, along with advances in technology, new ways of accessing capital, and increased financial regulation is challenging the future of this business model.

Democratisation of Information

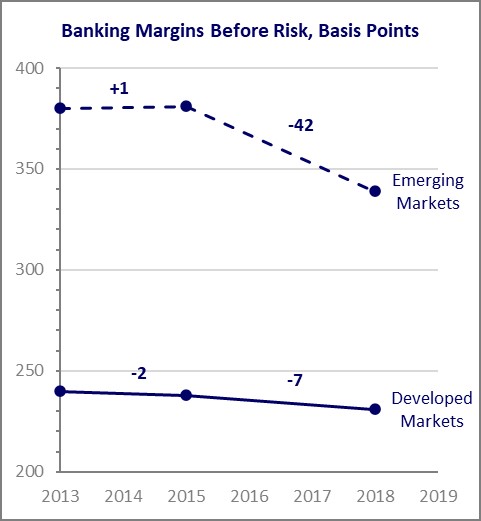

Prices have become more transparent, leading to an erosion of margins, as the graph above shows (Source: McKinsey). The figure below explains the factors behind this trend.

Disappearance of Proprietary Trading Within Banks

Through their market making activities, the banks had real-time information regarding supply and demand of financial products. In the past, they were able to monetise this by trading with their own money (proprietary or prop trading). With much higher capital charges, the Volcker rule, and a shift in attitude to risky activities from shareholders, prop trading has been all but abandoned by banks.

Declining Demand for Capital Markets Funding

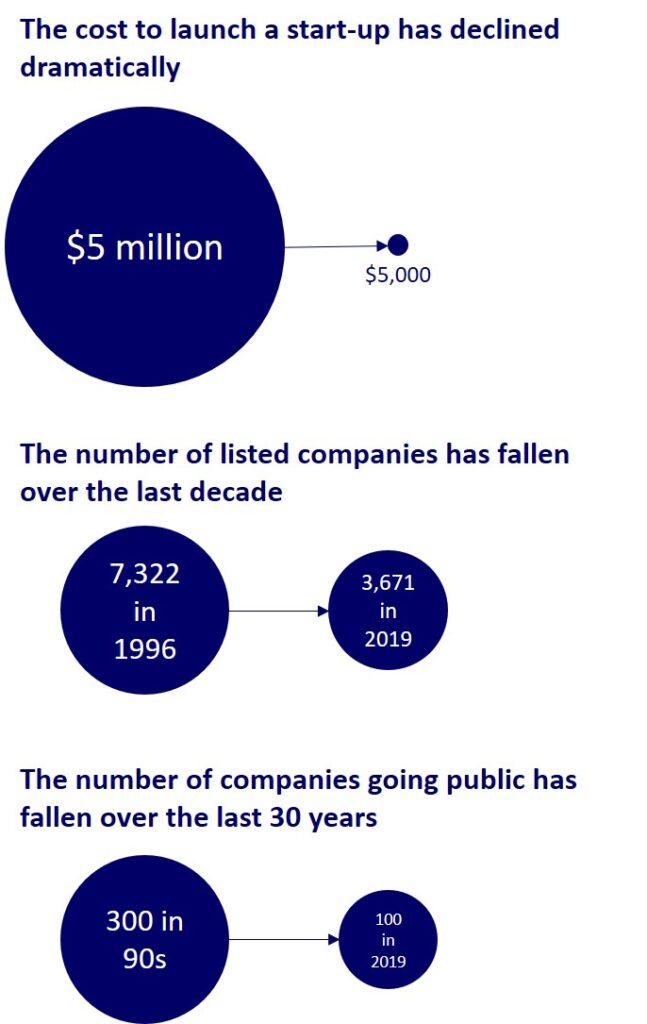

- The growth of online services and advent of cloud computing has lowered the demand for capital from companies, particularly start-ups.

- Furthermore, there has been a growth in alternative sources of funding to capital markets, such as angel funds, venture capital, and crowdfunding. See the figure below for more details (Source: Harvard Business School).

Demand from Investors

Investors such as funds have been facing increasing competition from digitalisation themselves, as well as their own customers pushing for lower fees. Consequently, many investment firms have set up their own trading facilities to take advantage of the digitalisation of markets.

Furthermore, investors now have many more viable options outside of capital markets. Private equity and venture capital are obvious ones that spring to mind. 2015-2019 were a record-breaking years for private equity.

Erosion of Barriers to Entry

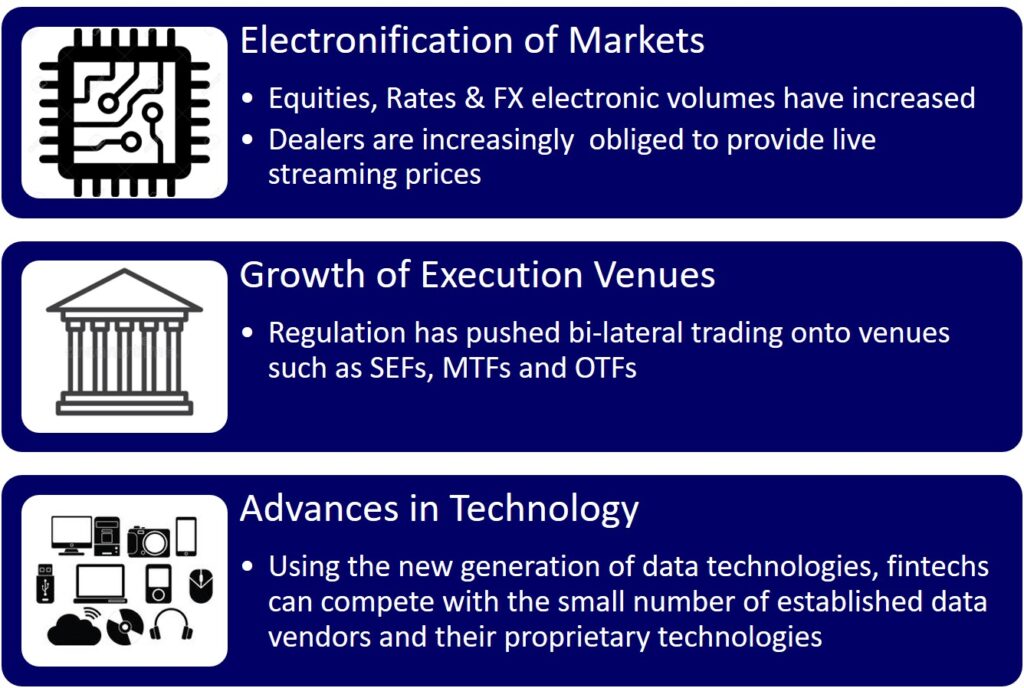

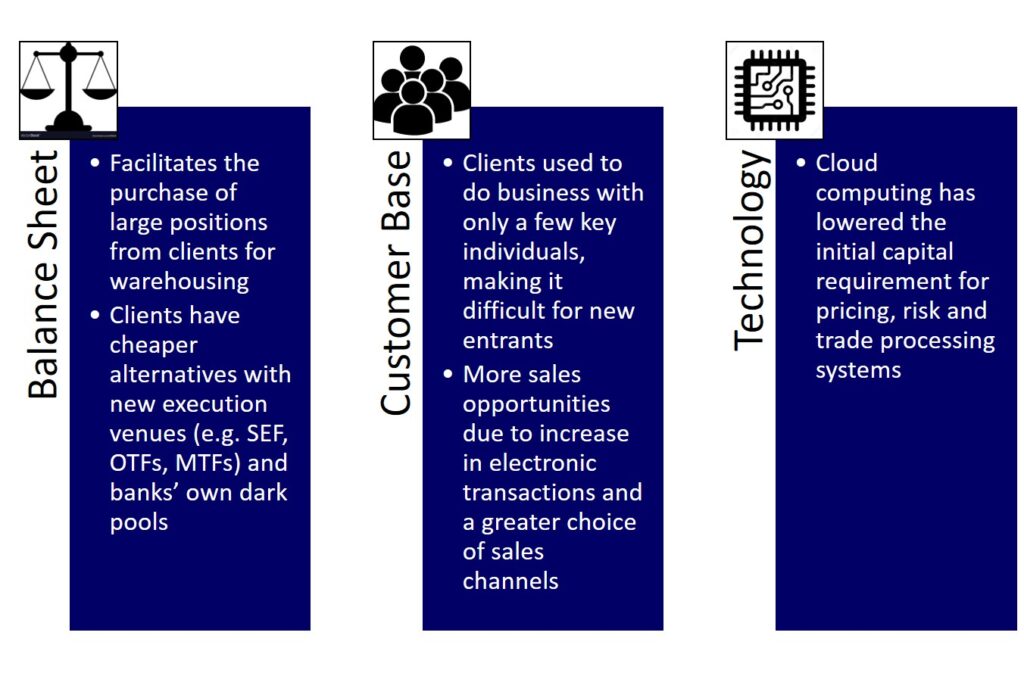

Historically, there were high barriers to entry for the investment banking business, leading to the majority of business being done by a handful of players. But structural changes and technological advances means that these barriers are being eroded. The figure below explains what these barriers are and how they are disappearing.

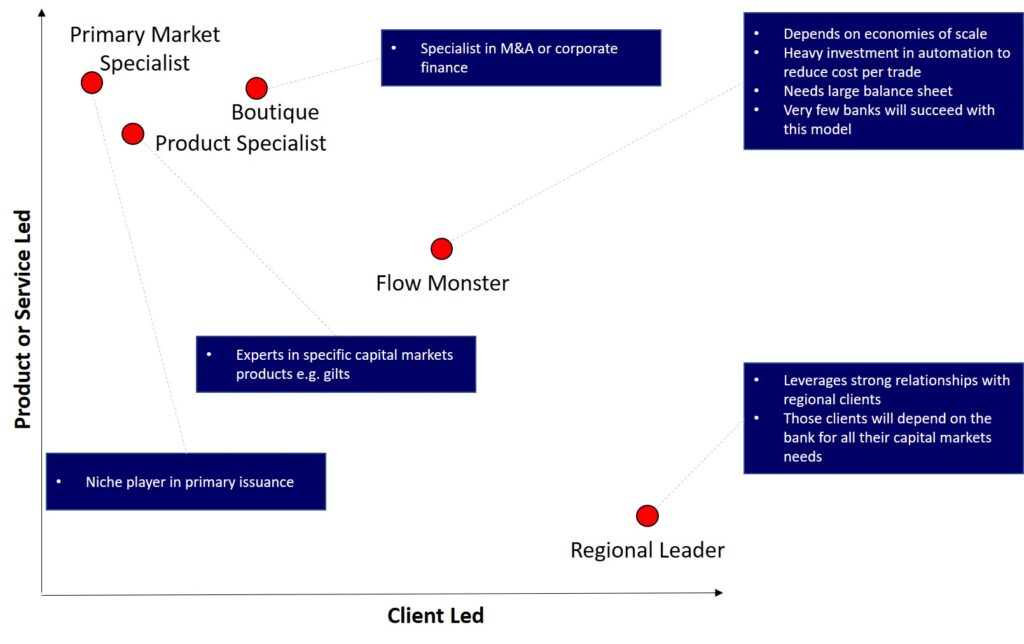

What Alternative Business Models Are There?

The full-service investment banking model is under threat. So, what are the alternatives?

Can the Banks Learn Lessons from Big Tech?

Drawing parallels with other industries, some observers have suggested that the solution to these problems lies in digital transformation. However, the nature of the investment banking dilemma is different in a number of ways:

- Investment banking is a B2B activity – Not only that, but the number of customers is comparatively small. In contrast, many of the big tech companies such as Amazon, Apple and Google are primarily B2C businesses. This is hardly surprising, given that one of the main benefits of the internet is to facilitate communication at scale.

- Trading is already a technologically advanced business – investment banks have historically been big investors in technology. In asset classes such as Equities and FX, most of the volume traded is already electronic. In contrast, companies such as Uber have revolutionised industries that were not big users of technology

- The nature of the threat to the investment banking business is different from those in other industries:

- In other industries, start-ups have been a threat to bricks and mortar businesses by being more convenient for the consumer whilst being far cheaper to run. But fintechs have not had any significant impact on the investment banks revenues

- The main problems that the banks face are the increased cost of capital and the decreasing margins as a result of structural changes to capital markets

This is not an excuse for complacency however. The banks still need to make very significant changes if they are to survive:

- The full-service investment bank is not going to be a profitable business model for all but a very few banks as argued above. Most organisations are going to have to decide how to become more focused (see “What Alternative Business Models Are There?”)

- Whilst digital transformation is not a panacea, using technology to provide a great customer experience and to reduce costs is central to success

How Can Technology Be Used to Succeed?

To build a successful technology platform, there are two things that need to be done well:

- Vision

- Execution

Vision

The first and most important rule is that your technology platform must solve your customers’ problems to succeed:

- Improving the customer experience can occur at different stages:

- Before the transaction – helping your customers to decide on a product

- During the transaction – making it easy for them to execute

- After the transaction – customer service, post transaction automation

- You must do these better than your competitors, and you have to do it before your competitors

- Companies such as Amazon and Apple have grown because they always put the customer first, even ahead of shareholders

The second rule is that there must be a genuine collaborative partnership between business and technology.

- Without business, there is not enough clarity of what customers’ problems actually are

- Without IT, there is not enough understanding of technology solutions, and what is possible or not

The third and final rule is that your organisation must be aligned around the vision.

- The C-suite need to make resource and funds available and put the right organisation in place

- Line and change functions need to work together to design the target state

- Technology functions need to build the platform

Execution

If the vision phase is analogous to product design, then the execution phase is about production. Continuing with the manufacturing analogy, to produce high quality goods, there must be investment in the factory. For investment banking technology teams, this means a big change in approach to technology.

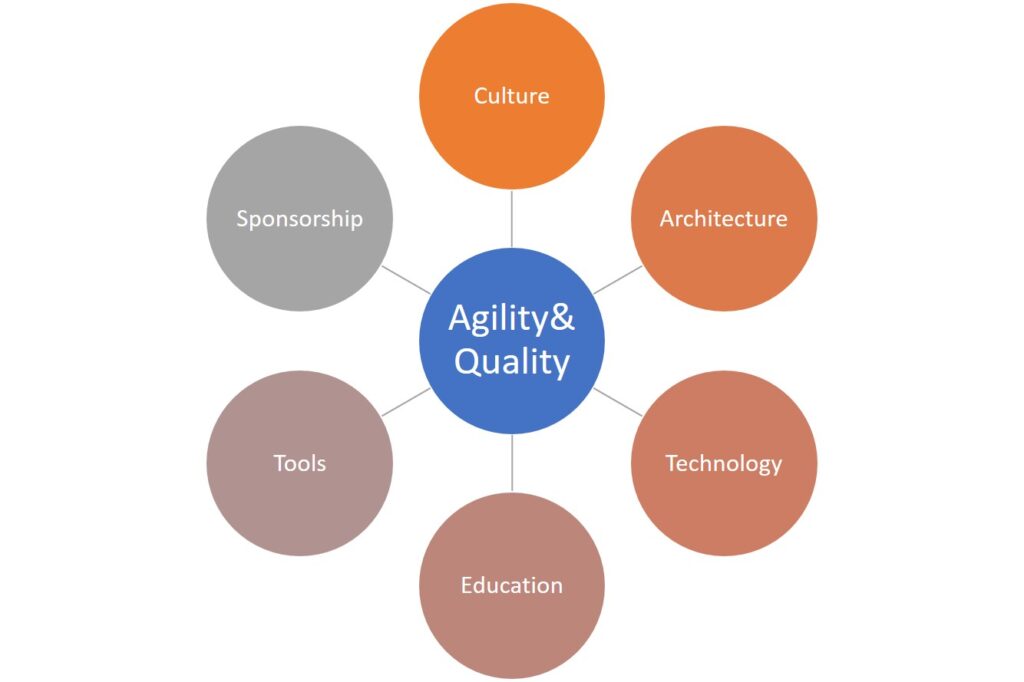

The goals of this change should be twofold: agility and quality. There are 6 levers that can be utilised to reach these goals:

- Cultural change

- The goals of technology management within the banks have been to deliver incremental improvements without breaking production systems. The processes and culture that exist today support that goal

- Delivering transformative change with no downtime is the new goal. This requires a new way of thinking

- Architecture

- The big technology companies take a different approach to banks. They have a big focus on non-functional requirements such as scalability, operational efficiency, and agility

- Some patterns and idioms to consider:

- Horizontal scaling: run your system across a larger number of commodity machines instead of a few high-end machines. This makes the system cheaper to scale and more reliable, but more complicated to write

- Blue-green deployments: run both old and new versions of software simultaneously at release time to reduce the risk of outage

- Microservices: this approach facilitates agility by dividing a system up into small discrete components that can be deployed independently

- Technologies

- Cloud computing: Enables agility through zero lead-time to bring additional capacity online. Furthermore, having essentially unlimited compute and storage on tap creates many new business opportunities. For example, risk can easily be run intraday on complex path dependent options.

- Machine Learning: The traditional approach to data analysis is to write hardcoded algorithms. But with machine learning, the algorithms are shaped by the data itself rather than being hardcoded by the programmer. This approach enables flexibility and agility.

- Developer education

- The banks are finding it increasingly difficult to create a capability in a new technology simply by buying staff. They face stiff competition from the tech firms. To counteract this, there needs to be an increased focus on building this capability internally through training and education

- Modern engineering practices emphasise automating the manual repetitive tasks in software development such as testing and deployment. But many banks’ technology teams have not yet adopted this approach. After all, if those teams are working on legacy systems, and on maintenance or incremental improvements, what motivations are there to change? Education and process can help with this transition

- Developer tools

- The best tools for concerns such as software version control, build, deploy, and configuration management make a huge difference to productivity. Make sure these tools are not sat waiting to be approved by central teams

- Business sponsorship

- It has always been a challenge to get investment in engineering prioritised within most of the banks. But given the importance of technology today, it cannot continue to be a secondary concern. It is up to IT departments to educate their business customers as to the benefits of investment in engineering

Conclusion

- The full-service investment banking model has a limited lifespan

- Banks need to focus on a smaller set of services

- Technology is essential to excelling at those services in the modern digital world. To succeed, you must have:

- A vision for a technology platform that solves your customers’ problems

- An effective IT delivery capability focused on agility and quality